INDUSTRY NEWS

SPONSORED CONTENT

VIDEO & LIVE STREAM

⭐ RESOURCE SHORTCUTS

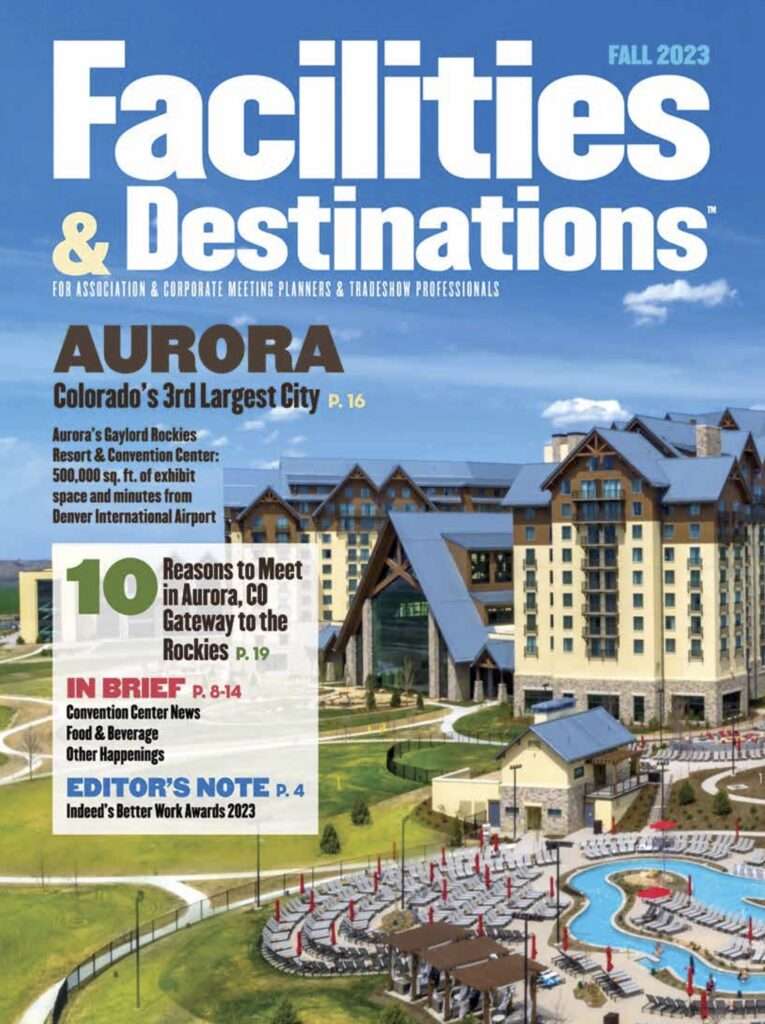

Facilities & Destinations Magazine

Facilities and Destinations (F&D) is a quarterly trade publication for the meetings & events industry.

See More

F&D Future-Driven Leaders: Spring 2022 Designees

Best Up-and-Coming Professionals, a new designation recognizing the rising stars

See More

F&D Safe Sites: Spring 2022 Designees

Voting Closed

See More

Facilities & Event Management Magazine

Facilities & Event Management (F&EM) is a semi-annual trade publication for the live event's industry.

See More

2022 F&EM A-Lister Designation

Consider who are this year’s

A-Listers, and take a moment to

fill out the ballot below and nominate individuals

See More